If you have a mortgage on your home, as most homeowners do, then your home has probably earned some equity.

Equity is the difference between the amount you owe on your home and what your home is actually worth. As an example, if your home is worth $300k and you owe $150k on your mortgage, you have earned about $150k in equity on your home.

Home equity is the perfect place to turn to for funding a home remodeling or home improvement project. It makes sense to use your home’s value to borrow money against it to put dollars back into your home, especially since home improvements tend to increase your home’s value, in turn creating more equity. By using equity to increase your home’s value, you can sometimes use the new equity you’ve created to pay for the old equity you borrowed … but only if and when you sell the home.

About 50 percent of home equity loans are used to make home improvements, according to the US Census Bureau’s Housing Survey. While home equity seems to be made for home improvements, it can be better for some project than others. There are a few factors to consider when using your home’s equity to pay for a remodeling project, including how long you plan to stay in the home, the estimated return on your investment, tax benefits, and alternative loan options.

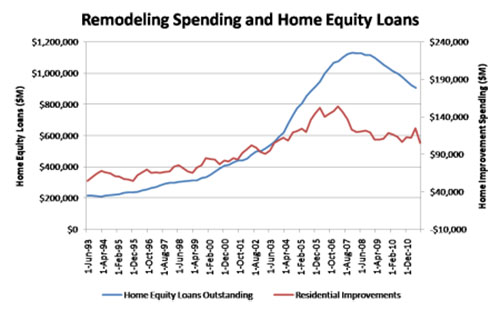

The charted data from the US Census Bureau shows that an increasing number of homeowners are using home equity dollars to make home improvements.

The pros and cons of home equity for remodeling

As mentioned before, your home’s equity is based on both it’s value and the amount you owe on the home. The amount you own on the home is always going down and helping increase your equity, as long as you pay the mortgage each month. But your home’s value can go down too, decreasing your equity.

When the market’s up and the value of your home is more than you paid for it, it gives you a lot of equity to put back into the home. But when the market’s down, it can cause the value of your home to fall below the amount of money you still owe, leaving you with no equity or even negative equity.

Making a bigger down payment on your home will increase its equity as well. A 20 percent down payment on a house you’re buying for $300k instantly gives you $60k in equity as soon as you start making payments on the home. If the home increases in value by 20 percent the day after you buy it, you’ve already earned $120k in equity on the home.

The ability to put money back into your home is one of the major benefits of home equity. Home equity dollars are commonly used to fund projects like this Case Design/Remodeling kitchen remodel.

Equity can be a real blessing, as long as you don’t end up with a home that’s worth less than you paid for it. In an older or outdated home, using the equity to make improvements can be one way to increase its value and earn more equity.

The difference between a home equity loan and a home equity line of credit

With both a home equity loan and a home equity line of credit, money is borrowed against your home with the home itself serving as the collateral for the loan. But the difference between the two is that a home equity loan is fixed loan with a set payment schedule and a home equity line of credit is a revolving line of credit with a variable interest rate and repayment schedule.

A home equity loan is like a traditional loan. It is a second mortgage that can be lumped together with your first mortgage for one easy monthly payment under a fixed interest rate. A home equity loan can also be kept separate from the mortgage and paid off earlier. The borrower receives the entire sum of the loan at the time it’s taken out, so home equity loans are often used to pay for large, one-time purchases like a car, or to pay off outstanding expenses, such as student loans.

A home equity line of credit is more like a credit card than a loan. Once the line of credit has been approved, the homeowner decides if and when to use the money and can withdraw it from the account as needed. Payments aren’t due until there’s an outstanding balance on the line of credit. Home equity lines of credit are often used to pay for purchases that are made a little bit at a time, such for college tuition that’s paid once a semester over the course of four years.

Since home improvement and remodeling projects can be both one-time purchases and ongoing projects that are paid for a little bit at a time, both home equity loans and home equity lines of credit both are excellent options for financing home projects. The type of financing you choose will be based on your individual circumstances:

- Your plans for selling the home

- How long you plan to live in the home yourself

- The type of home improvements you’re making

- The amount of value the improvements add to your home

A home equity line of credit might be used to fund an ongoing home remodel that’s done room by room over the course of several months or years, while a home equity loan is usually better for funding one-time projects like this Case kitchen remodel.

Understanding the relationship between home equity and ROI

Home equity doesn’t exist in a vacuum when you’re using the money for a remodeling or home improvement project. A project like finishing an attic or updating a kitchen adds a lot of value to your home, while a project like remodeling a home office – although it may add a lot of value to your life – does not increase your home’s value as much.

Your return-on-investment (ROI) in a home remodel is the percentage of money spent on a project that you are able to recoup when the home sells. It’s important to remember that both a home’s equity and your return on its investments aren’t actualized until you sell the home. So if you never plan to sell your home, home equity becomes a whole new game.

A mid-range bathroom remodel costs an average of $12-20,000, according to statistics gathered by Remodeling Magazine. But with an average ROI of 62%, the homeowner is able to add significant value to the home with a bathroom upgrade such as this one.

Investing home equity money into a high-value home improvement helps increase your home’s equity. You can use the added equity to borrow more money against the home. If you continue to make improvements in the home, you can create a positive cycle of increasing your home’s equity and it’s value, a process that goes hand in hand.

In the example of a home valued at $300k with a remaining mortgage of $150k, the homeowner has $150k of equity in the home and decides to invest $50k in a major kitchen remodel. The average ROI on this investment is 65 percent, so the project adds $32.5k of value to the home. While the homeowner now owes $200k on the home, it is now valued at $332.5k. The homeowner has decreased the home’s overall equity by only $17.5k, and now enjoys a brand new $50k kitchen in a home that still has plenty of equity.

Home equity tax benefits and alternative remodeling loan options

Although there are exceptions, the interest paid on a home equity loan throughout the year can usually be deducted on your federal income tax return. This gives homeowners the option of saving some extra money on a remodel by using a home equity loan to pay for it, instead of securing a different form of financing. Home equity loans also offer homeowners a way to pay off other, higher interest loans at a lower interest rate with tax-deductible interest.

While a home equity loan is often the best way for many homeowners to finance a home improvement project, it’s not the right choice for everyone. For one thing, you can’t take out a home equity loan if your home has no equity. Personal loans are always an option, but they may not come with the same low, fixed interest rates as home equity loans and can’t be added to your current mortgage.

A cash-out refinance is an option for homeowners with little to no equity because it allows you to refinance your home for more than it’s worth. If the new loan has a lower interest rate than your mortgage and/or you wanted to refinance anyway, a cash-out refinance may be a viable alternative for funding your home remodel project with home equity.