When we meet with people to discuss remodeling their home, there are 3 topics that often come up. The first is the project itself- what is the goal of the project? We’ll spend time collaborating with the homeowner on ideas, possibilities and options for how these goals might be accomplished. The next topic is related to time. The timeframes involved in designing, developing, permitting, and constructing a project are of interest to most of the people we visit. Finally, we get to the big one – cost. How much does the project being considered cost? If you would like to know more about project costing, visit:

How Much Does It Cost to Remodel My Home?

How Much Does It Cost to Remodel My Kitchen?

How Much Does It Cost to Remodel My Bathroom?

After outlining an appropriate budget for what is being considered, we are often asked how people pay for projects?

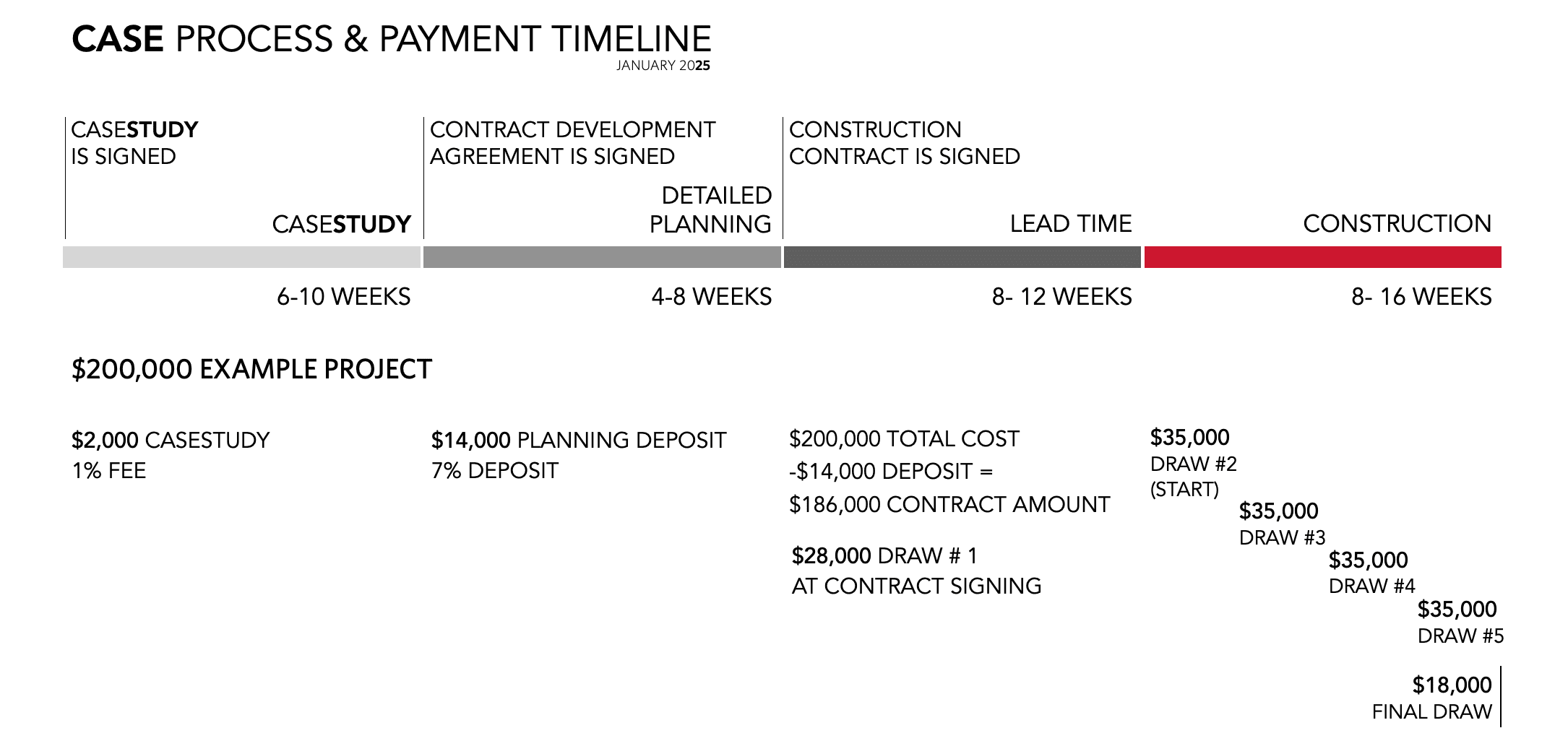

Before we outline options for how clients pay for projects, it might be helpful to understand when money is due on a project. Unlike many other purchases, you do not pay for a project all at one time. There are a series of draws or payments during the course of a project. To illustrate this, let’s use a $200,000 project. We will be using the Case process- other firms may operate in different ways.

For a Case project, we charge a 1% fee for preliminary design work. We call this process a CaseStudy–clever huh? To learn more about the specifics of a CaseStudy, visit the CaseStudy blog. Using our $200,000 project, that equates to a $2,000 fee to explore options for your project. This step involves a lot of work and multiple client meetings. Let’s estimate it to take 6-8 weeks. At the end of that time, our clients have a good idea of their options for the project and a better defined budget range and project timeline. If they decided to proceed into the Contract Development step, a 7% deposit is due. Using our example, that would be $14,000. This money is credited toward the construction contract.

We are 6-8 weeks into designing the project, and the total outlay has been $16,000 ($2,000 + $14,000). Now that we are in the Contract Development step, things start to get exciting. We’re making material selections, refining design decisions, and weaving trade specialist into the mix. At the end of this step, we have a comprehensive set of drawings that graphically depict everything included in the project. This step typically takes 6-8 weeks for a $200,000 project.

We are now 12-16 weeks into the design of the project and our outlay remains $16,000. Now it’s decision time. Are you going to build the project? If so, the next step is a construction contract.

Following our example and the Case process, the contract would be $200,000 but because the Contract Development payment was a deposit, the contract will be written for $200,000- 14,000 =$186,000. This not all due at the start of the project. This amount is broken down into a series of draw payments. The first is due when the contract is signed (Draw #1 $28,000 below). The next is due when work begins (Draw #2 $35,000 below). The remaining draws are due at specific milestones during the project. These are all clearly documented in the construction contract and are roughly evenly spaced through construction.

Here’s a graphic to help illustrate the timeline.

Now let’s move to how people pay for projects. First, you need to understand, that we are remodelers, not bankers. But, we work with enough clients to have a basic understanding of the options available to pay for a project. They vary with the specific situation, the project being considered, and several other factors. We encourage you to consult with an expert to determine the right option for you. With that said, the following are the most common options for paying for a project:

- Cash Savings

Paying with cash can be a cost-effective option since it avoids interest payments and debt.

Since you are paying for the entire project, plan carefully and make sure you have enough savings set aside for the project.

- Home Equity Loans (HELs)

A lump sum loan secured by your home’s equity, repaid over a fixed term with a fixed interest rate.

Often used for larger projects with a predictable cost.

Allows you to keep your current mortgage in place.

- Home Equity Line of Credit (HELOC)

A revolving line of credit secured by your home’s equity.

Flexible borrowing—draw on funds as needed and pay interest only on the amount used.

Often have a variable interest rate.

- Cash-Out Refinance

Replaces your current mortgage with a new, larger one, giving you cash based on your home’s equity.

Often carries a fixed interest rate but will extend your mortgage term.

Works especially well if current interest rates are lower than your existing mortgage rate.

- Personal Loans

Unsecured loan with fixed monthly payments.

No collateral required, so faster approval but higher interest rates.

Best used for smaller projects or by homeowners without significant home equity.

- Construction Loans

Uses the future / improved value of the property.

Ideal for large projects that are adding significant value to the property.

Some lenders may have options that do not impact your current mortgage.

Choosing the right financing is an important part of your remodeling project. The best choice depends on your financial situation, project size, and long-term goals. Whether you’re using savings, leveraging home equity, or exploring other loan options, careful planning ensures a smooth remodeling process without unnecessary financial strain.